Extra Space Storage is a $32 billion self storage real estate investment trust (REIT) headquartered in Salt Lake City, UT. We’re a member of the S&P 500 (NYSE: EXR) and have a highly diversified portfolio with more than 2,100 properties across 41 states in the U.S.

Jeff Norman, Senior Vice President of Capital Markets and Investor Relations, recently took a few minutes to recap our fourth quarter earnings for 2021 and our 2022 outlook.

2021 Fourth Quarter Earnings

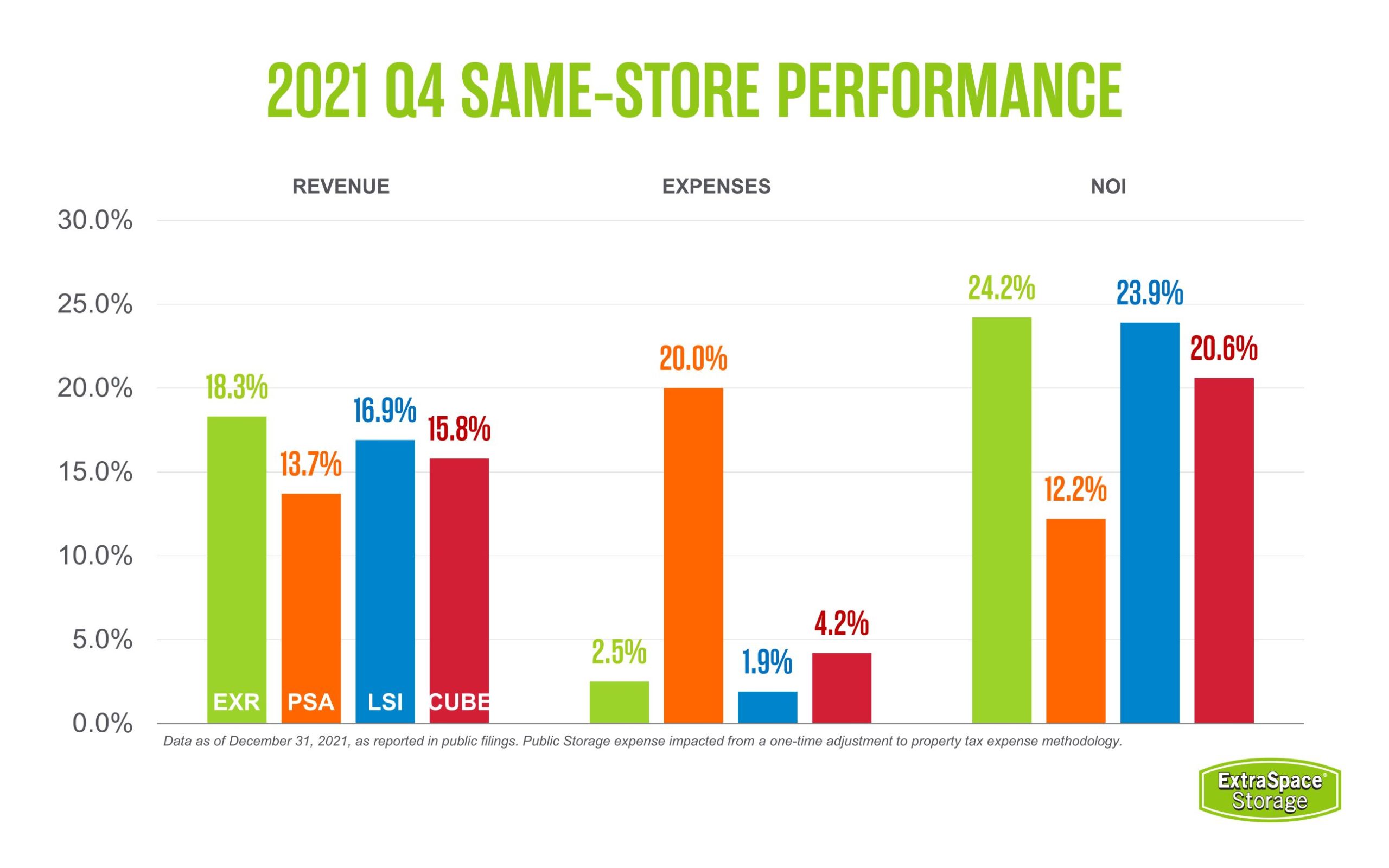

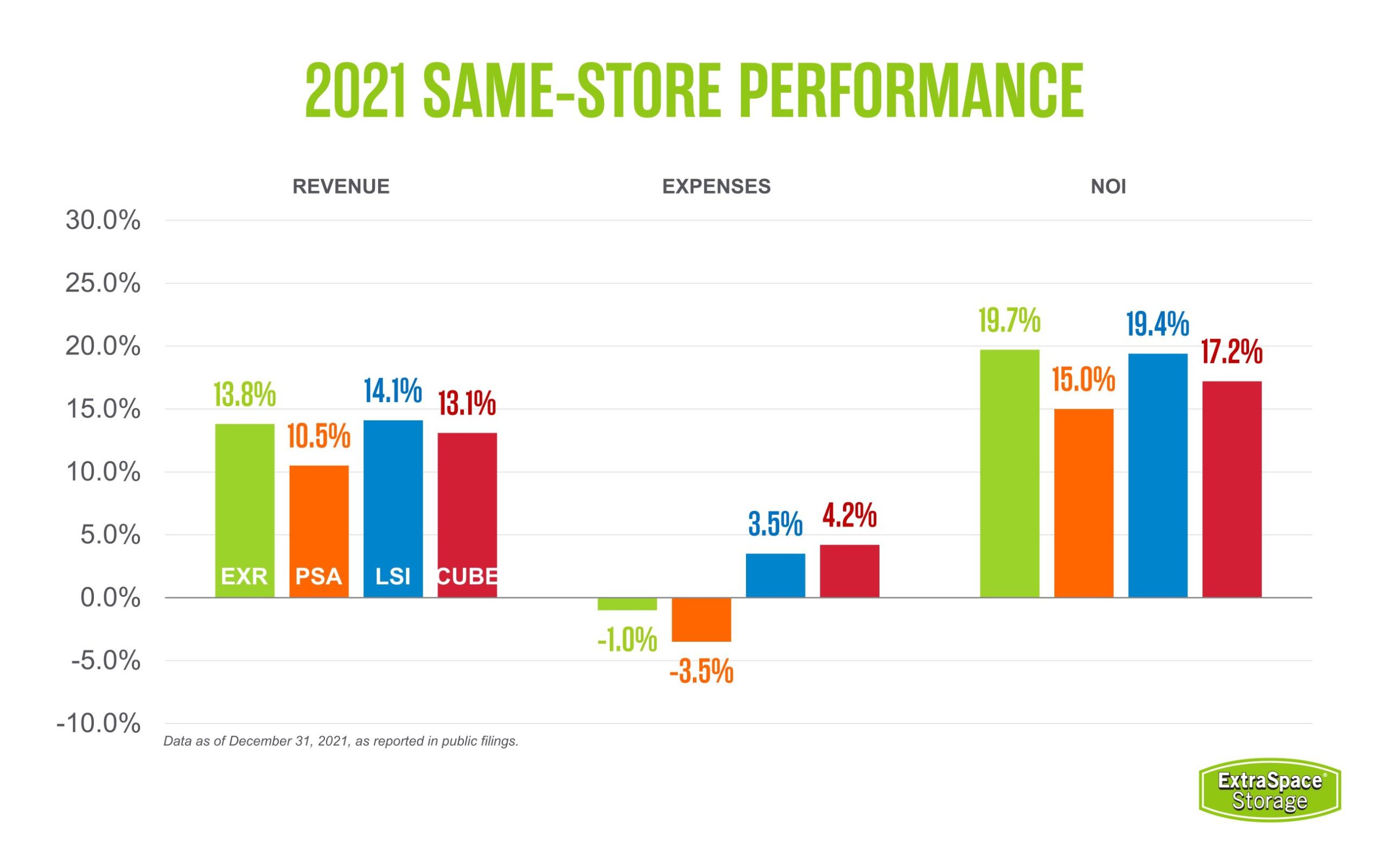

Operational performance in the fourth quarter was extraordinary across the storage sector with Extra Space Storage leading the pack with same-store revenue growth of 18.3% and net operating income (NOI) growth of 24.2%. This capped off a record-breaking year for Extra Space Storage during which we delivered same-store NOI growth of 19.7%.

Same-store performance was driven by record-high occupancy that remained elevated through the end of the year and did not experience as much seasonality as typically seen in the sector during the winter months. This high occupancy has been driven by steady demand, increasing tenant length of stay, and manageable vacate activity.

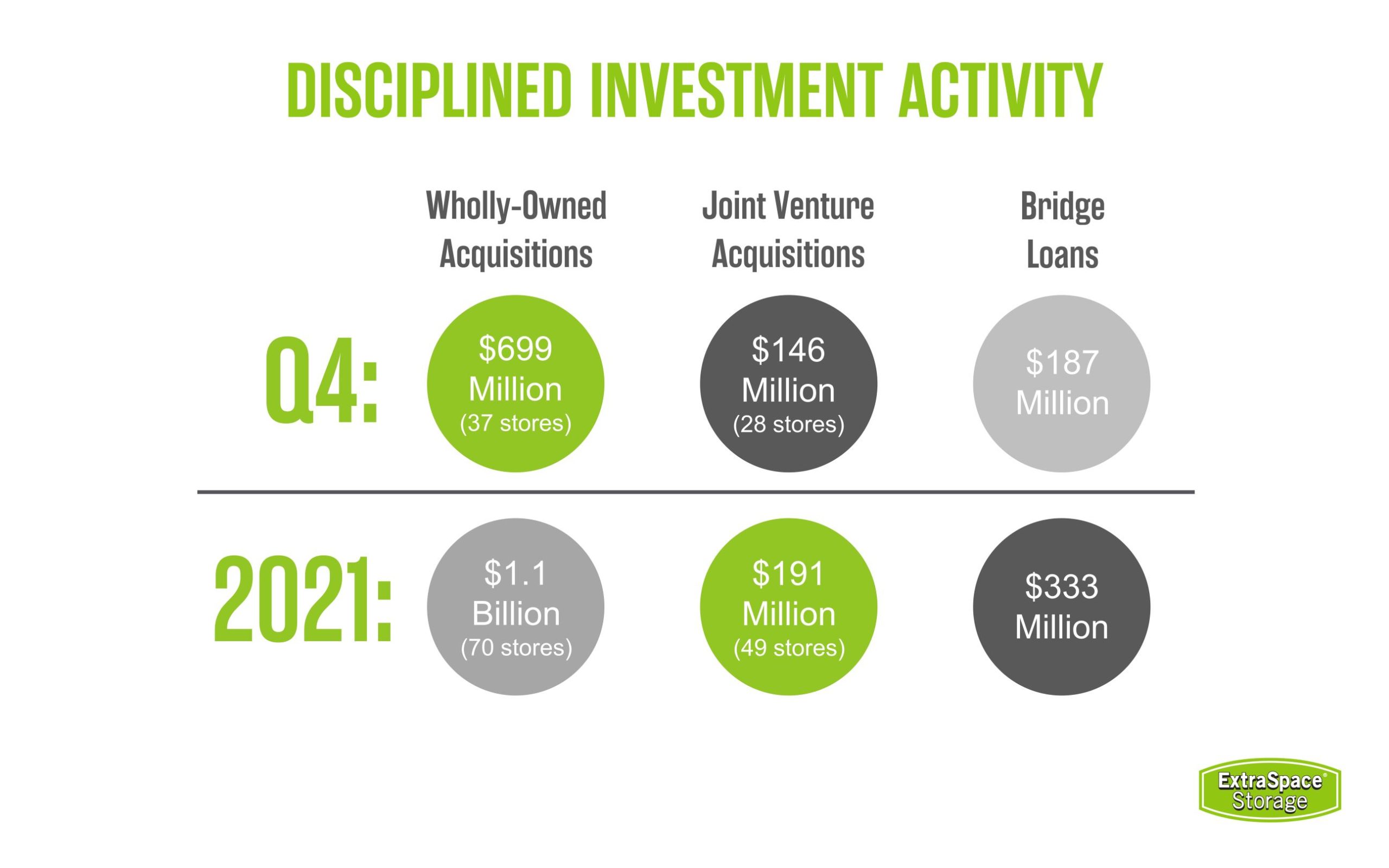

We had another strong quarter of acquisition activity and we were also active in originating and selling bridge loans. For the full year in 2021, we were able to do significant acquisition volume while maintaining our discipline to avoid larger brokered portfolios which have generally been selling at premiums.

Our acquisitions were typically in small transactions spread across our national portfolio, and for the most part were non-stabilized properties, which we believe will yield higher long-term returns for our shareholders in exchange for short-term dilution in 2022. Total acquisition volume exceeded $2 billion some of which was acquired together with a joint venture partner with Extra Space Storage contributing $1.3 billion.

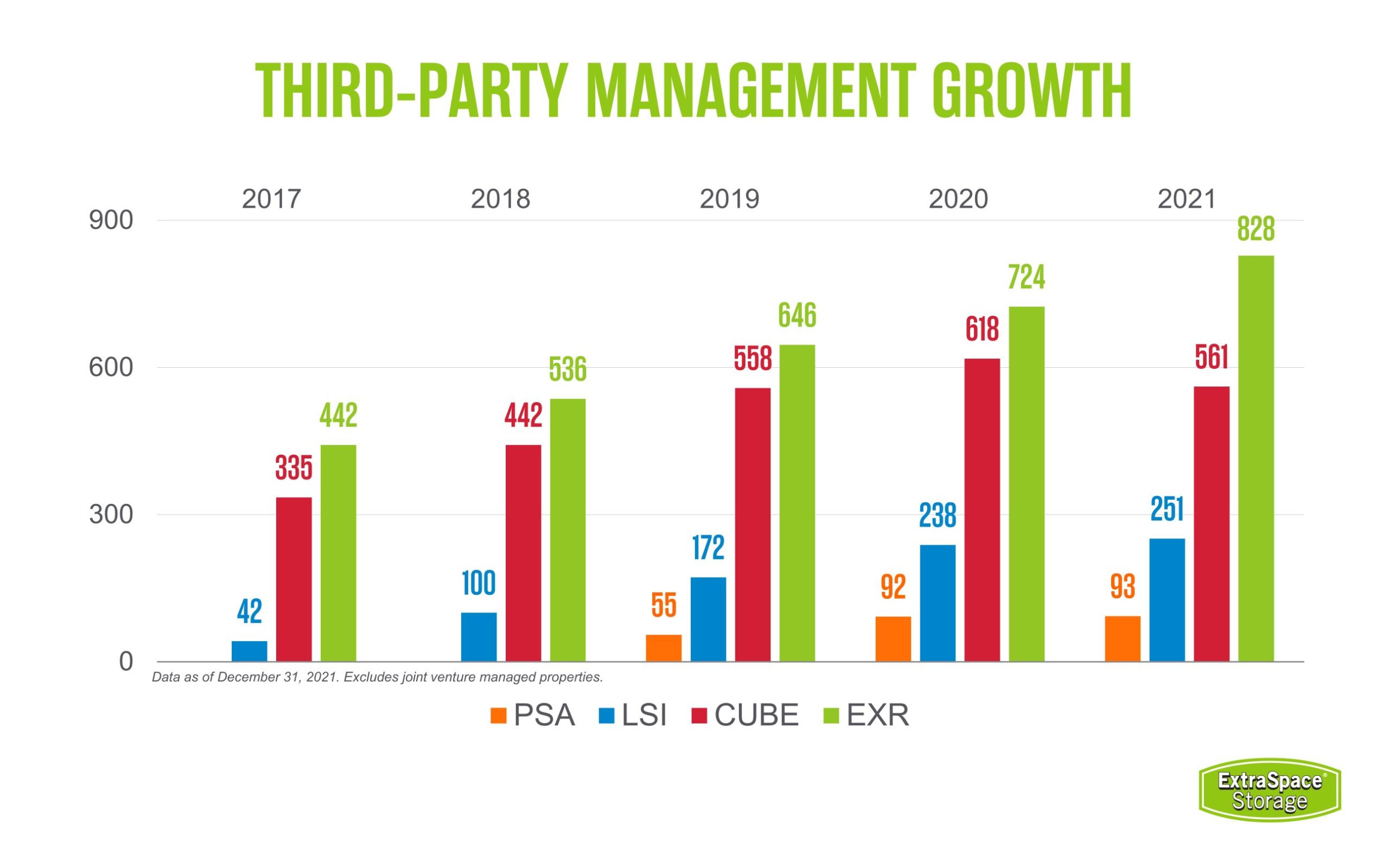

We also added 69 stores to our third-party management platform and we continue to be the largest and most profitable third-party manager in the industry.

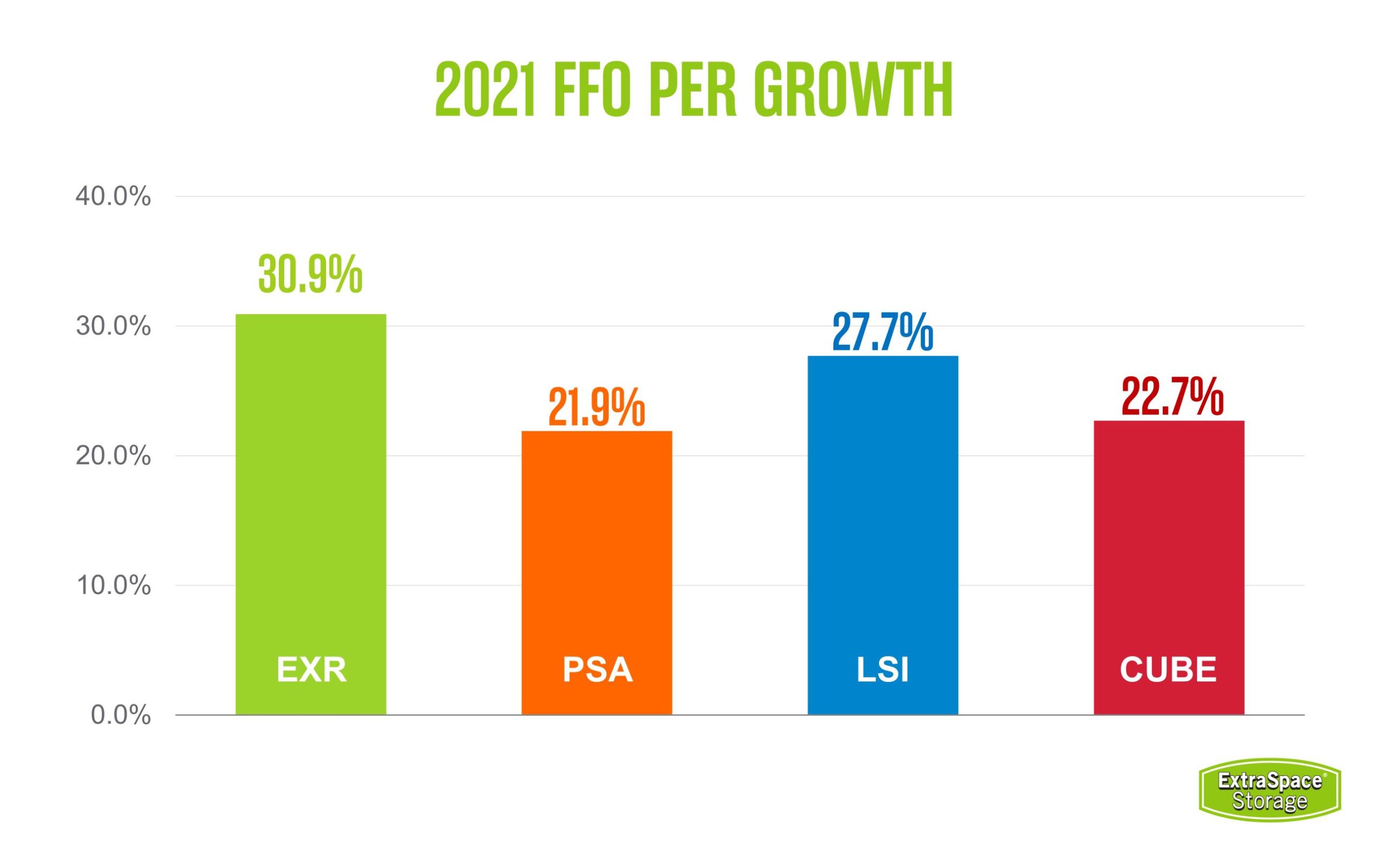

Our strong same-store results plus our efficient external growth coupled to produce exceptionally strong core FFO (funds from operations) growth on a per-share basis of 31% in 2021, well ahead of consensus estimates. This allowed us to increase our dividend twice in 2021 and again in the first quarter of 2022 to a run rate of $1.50 per share. A total increase of 50% over the 2021 first-quarter dividend.

2022 Outlook

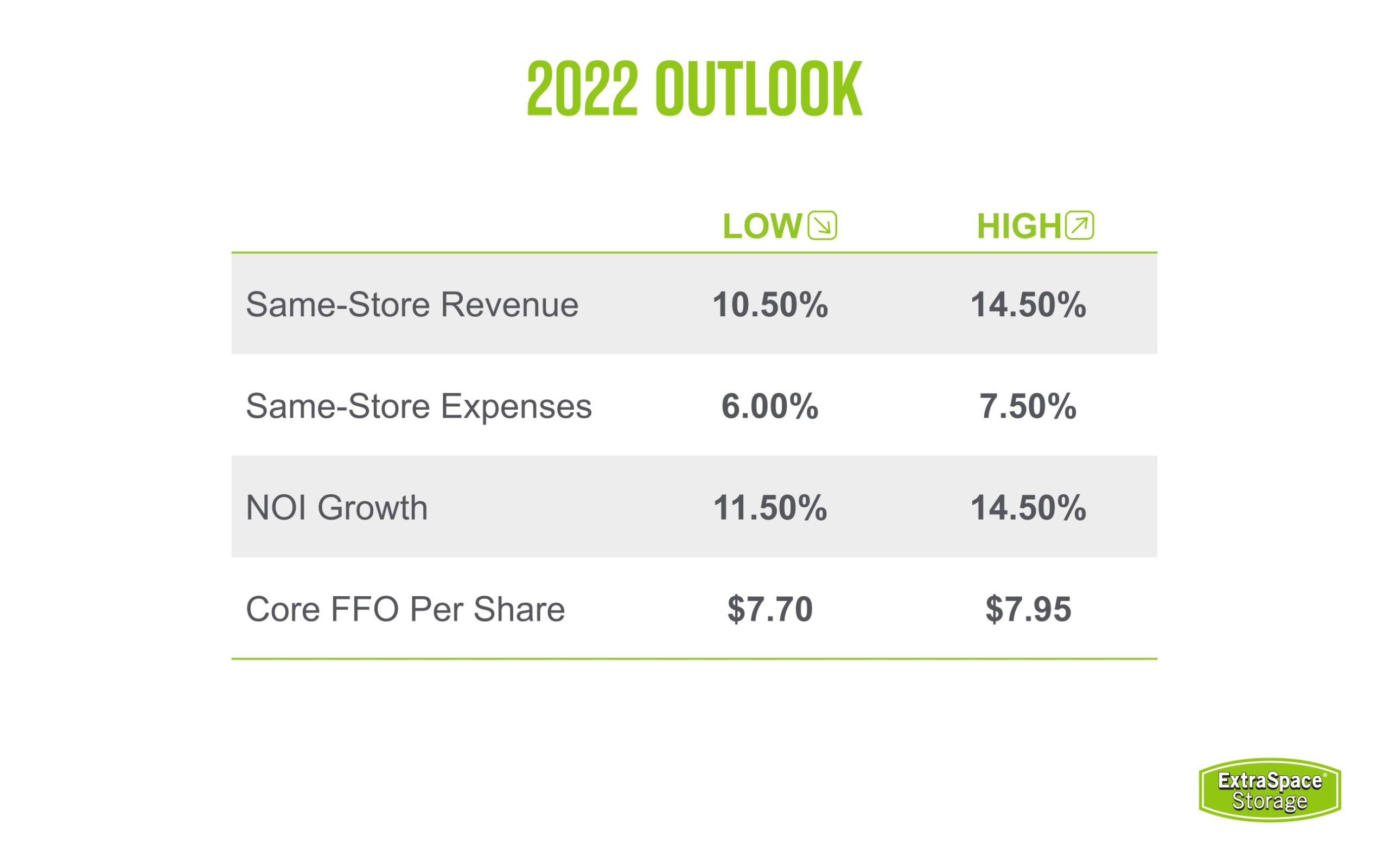

As we look forward to 2022 we are well-positioned for another strong year of same-store and core FFO growth. In our 2022 outlook, we project same-store revenue growth of 10.5% to 12.5%, primarily driven by rate. Expense growth is expected to be higher than normal at 6% to 7.5% with the primary drivers being payroll, property taxes, and marketing expense.

This results in an anticipated NOI growth range of 11.5% to 14.5%, the highest initial NOI growth guidance in our company’s history. We’re guided to core FFO per share of $7.70 to $7.95 per share which represents 13.3% growth at the midpoint and 15% FFO growth at the high end of the range. We are guiding to $500 million in investment in acquisitions, half of which has been closed or is under contract, and another $120 million in bridge loans.

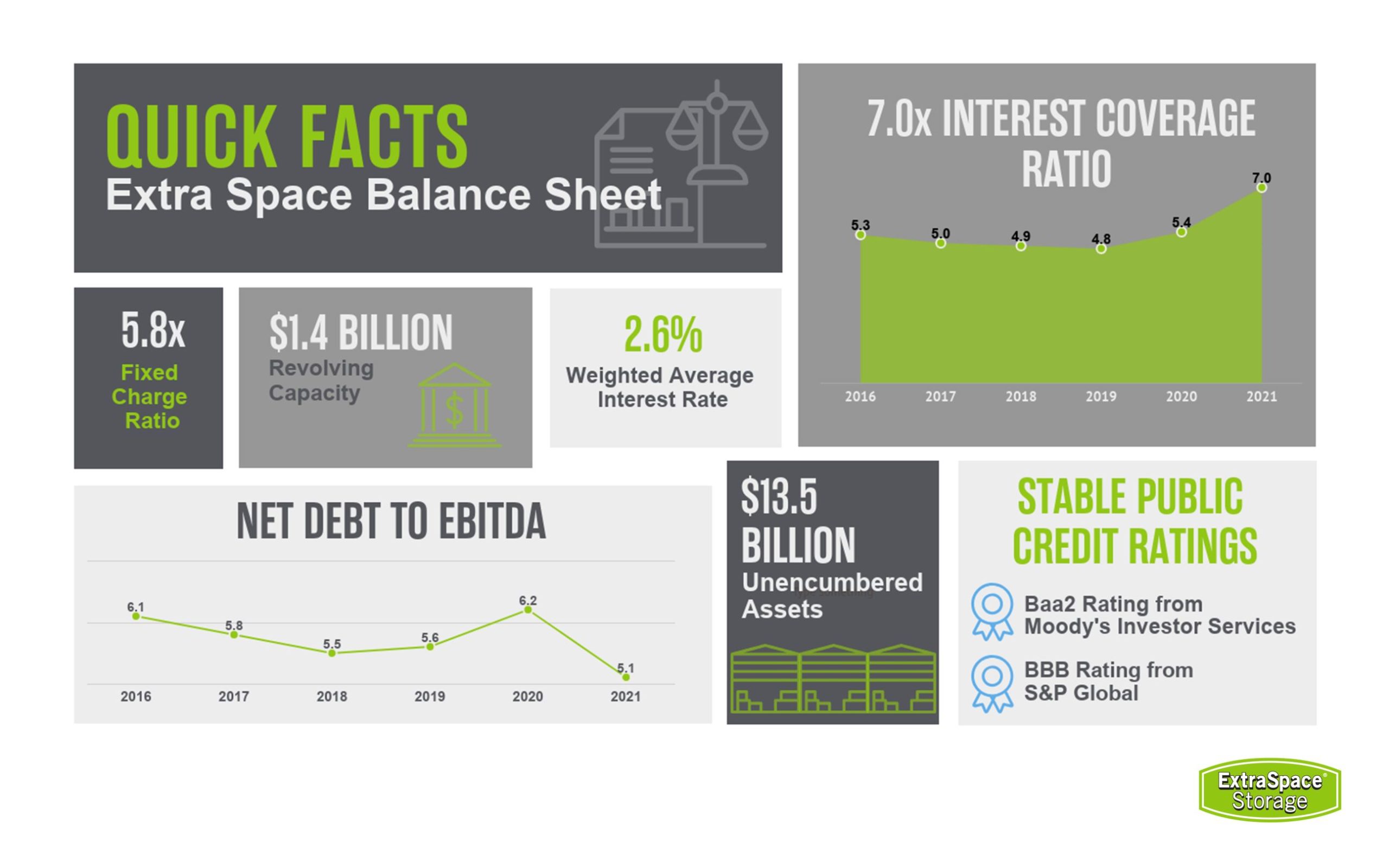

Our BBB/Baa2 balance sheet is very well positioned to support this anticipated growth. Our leverage has never been lower and our unencumbered asset pool is over $13 billion—larger than the market capitalization of most of our storage peers. We have significant revolving capacity on our line and only 8% of our debt matures over the next two years.

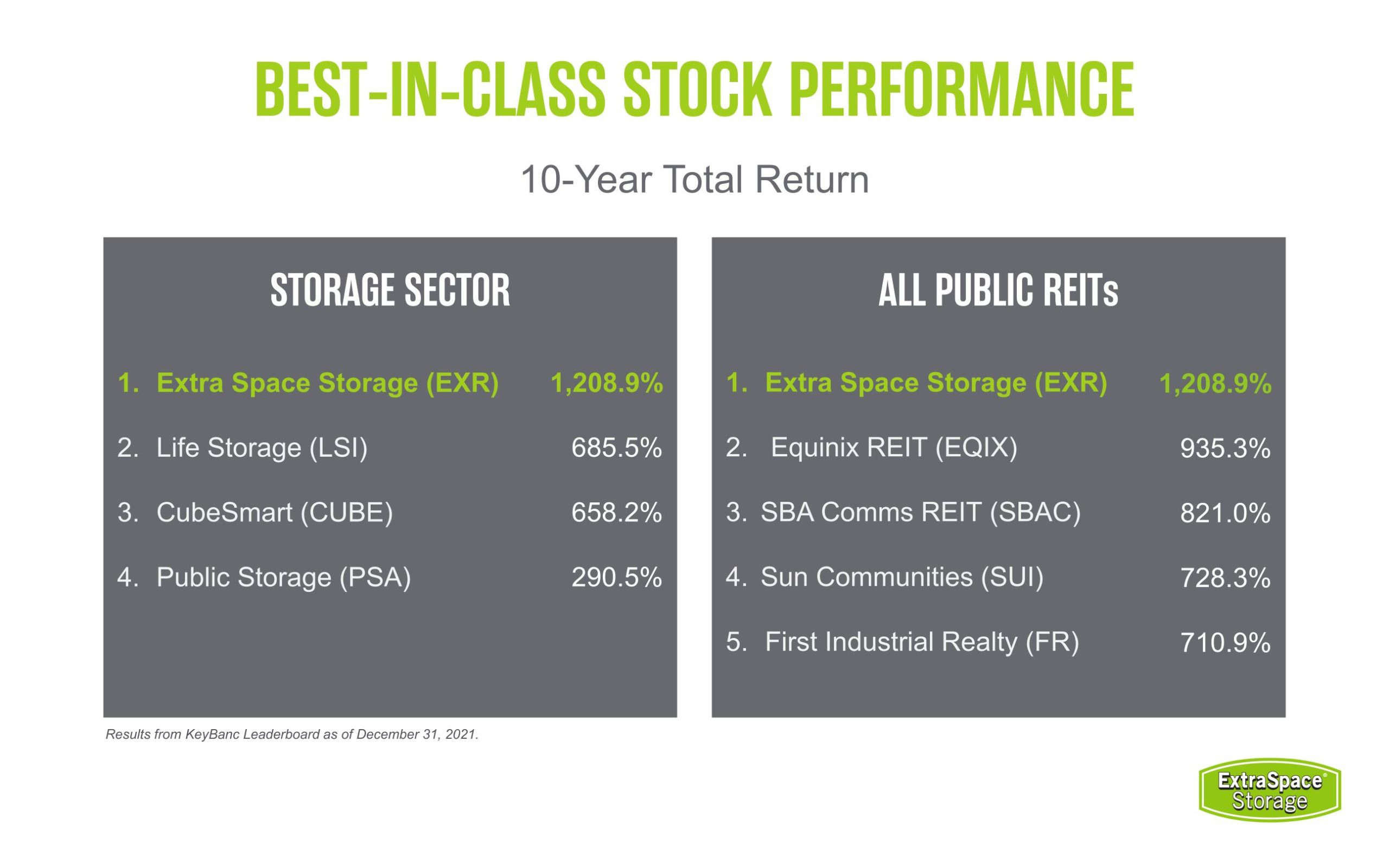

We believe that 2022 will add another year toward a long-term track record of core FFO growth outperformance in the REIT sector. We believe this is a primary driver of our sector-best 10-year total shareholder return, and the highest 10-year total return among all REITs at the end of 2021.

We are excited to report another strong quarter and pleased with how 2022 is unfolding. As we always say, it is a great time to be in storage.

Want more investor-focused content? The Extra Space Storage (EXR) investor relations site hosts over a decade of quarterly earnings reports, profiles on our Board of Directors, our latest financial news, and much more!