Extra Space Storage is a $29 billion self storage real estate investment trust (REIT) headquartered in Salt Lake City, UT. We’re a member of the S&P 500 (NYSE: EXR) and have a highly diversified portfolio with more than 2,000 properties across 41 states in the U.S.

Jeff Norman, Senior Vice President of Capital Markets and Investor Relations, recently took a few minutes to recap our third-quarter earnings for 2021.

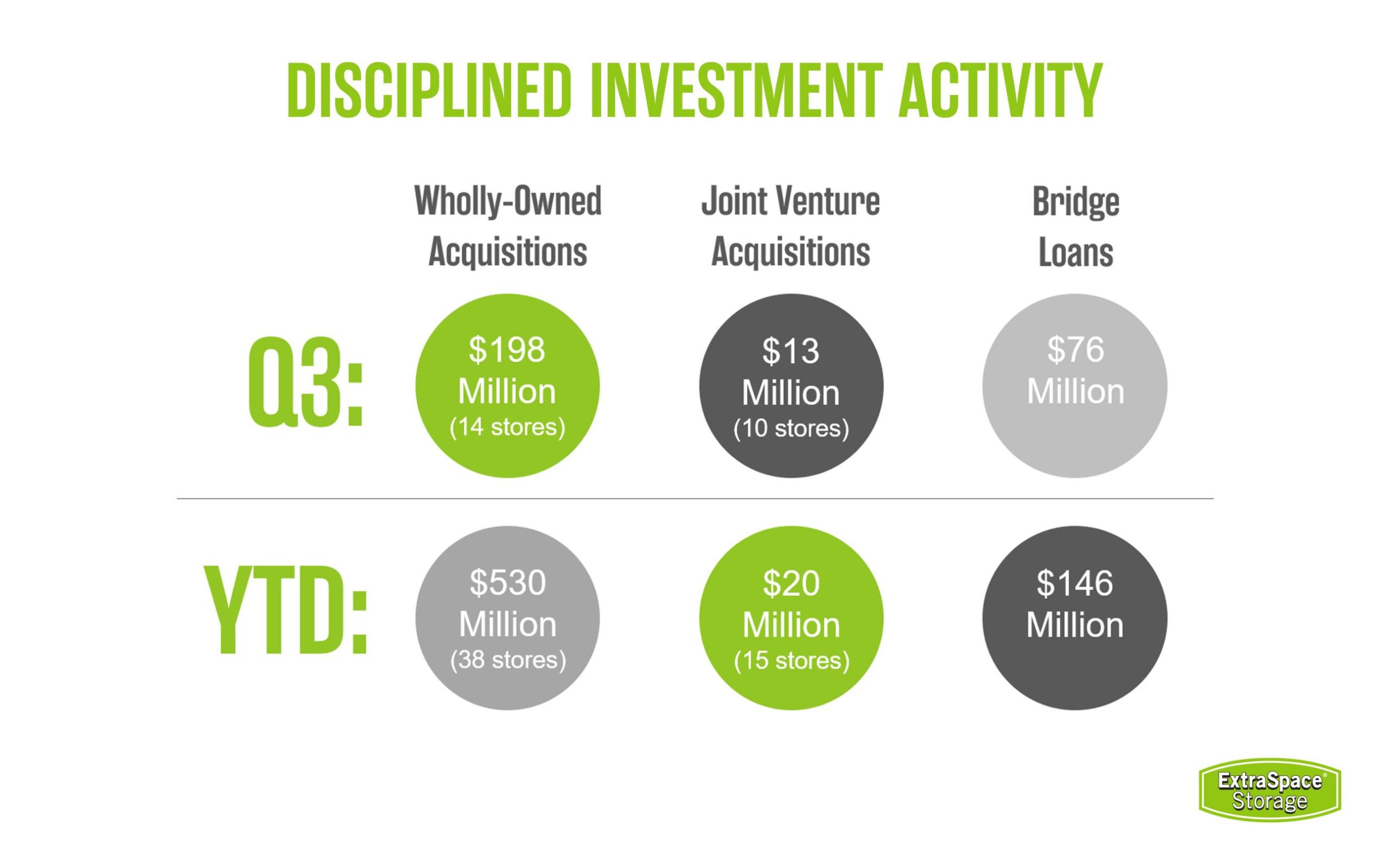

In this quarter, we continued to expand our highly diversified portfolio utilizing our flexible capital-light ownership structure, with an efficient balance of wholly-owned, joint venture, and third-party managed properties, all of which carry the Extra Space Storage brand.

Our balance sheet and our access to capital has never been stronger. Our leverage continues to drop and our unencumbered pool continues to grow, and we will continue to comfortably operate within our BBB and Baa2 credit ratings.

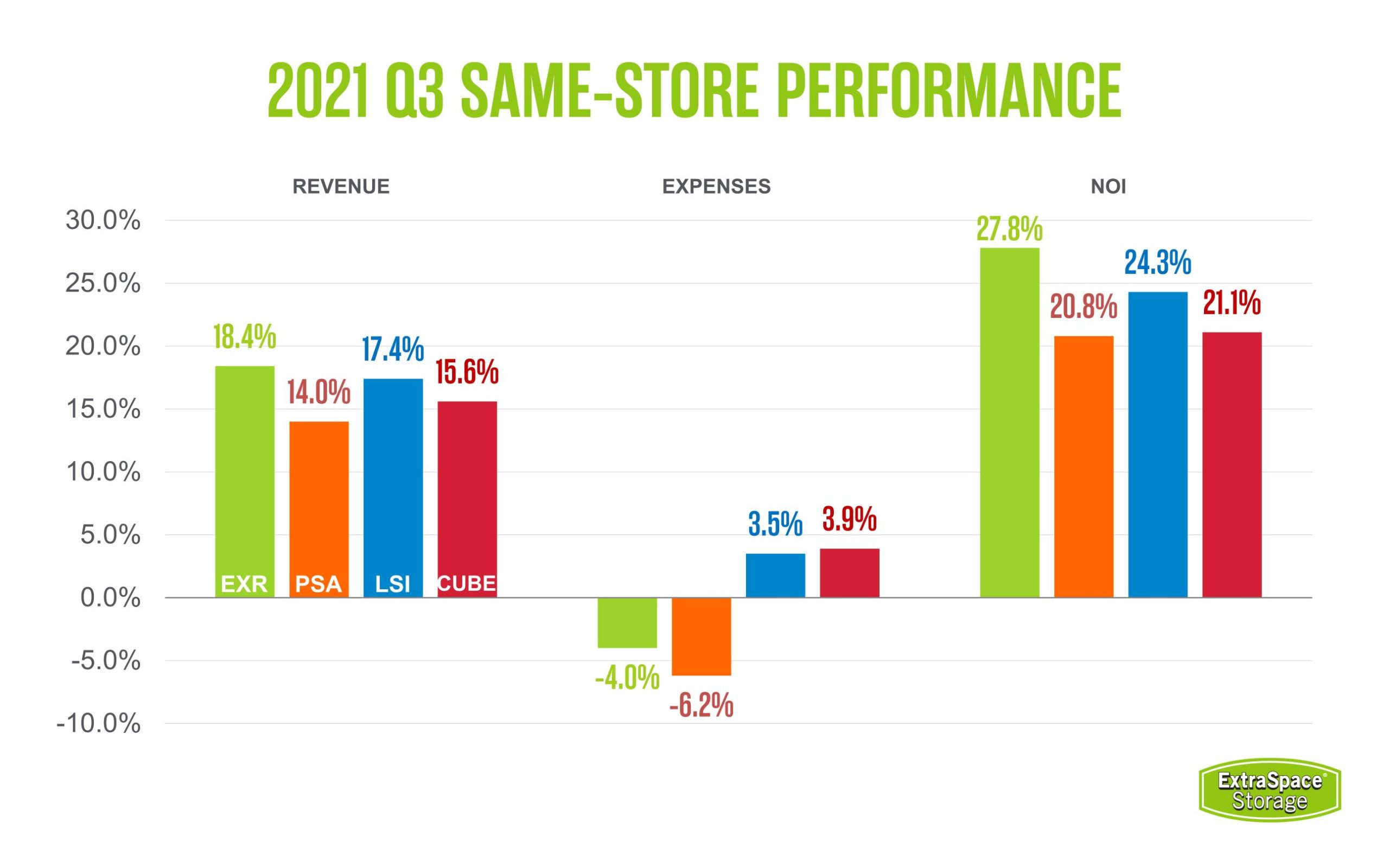

Same-store performance was incredibly strong across the storage sector with Extra Space Storage leading the pack. With same-store revenue growth of 18.4% and same-store net operating income growth of 27.8%.

Performance was driven by record-high occupancy that has remained elevated through the end of October and has not experienced as much seasonality as typically seen in the sector. This high occupancy has been driven by very steady demand increasing tenant length of stay and muted vacant activity, which in October, came in below historical averages for the 20th consecutive month. These factors lead to significant pricing power for both new and existing customers.

We had another strong quarter of external growth activity. We have been selective on which assets we buy and how we capitalize our acquisitions given the market’s elevated pricing levels. We have also been actively originating and selling Bridge Loans and continue to view our lending platform as an acquisition pipeline. We added 96 stores to our Third-Party Management platform, and we continue to be the largest and most profitable third-party manager in the industry.

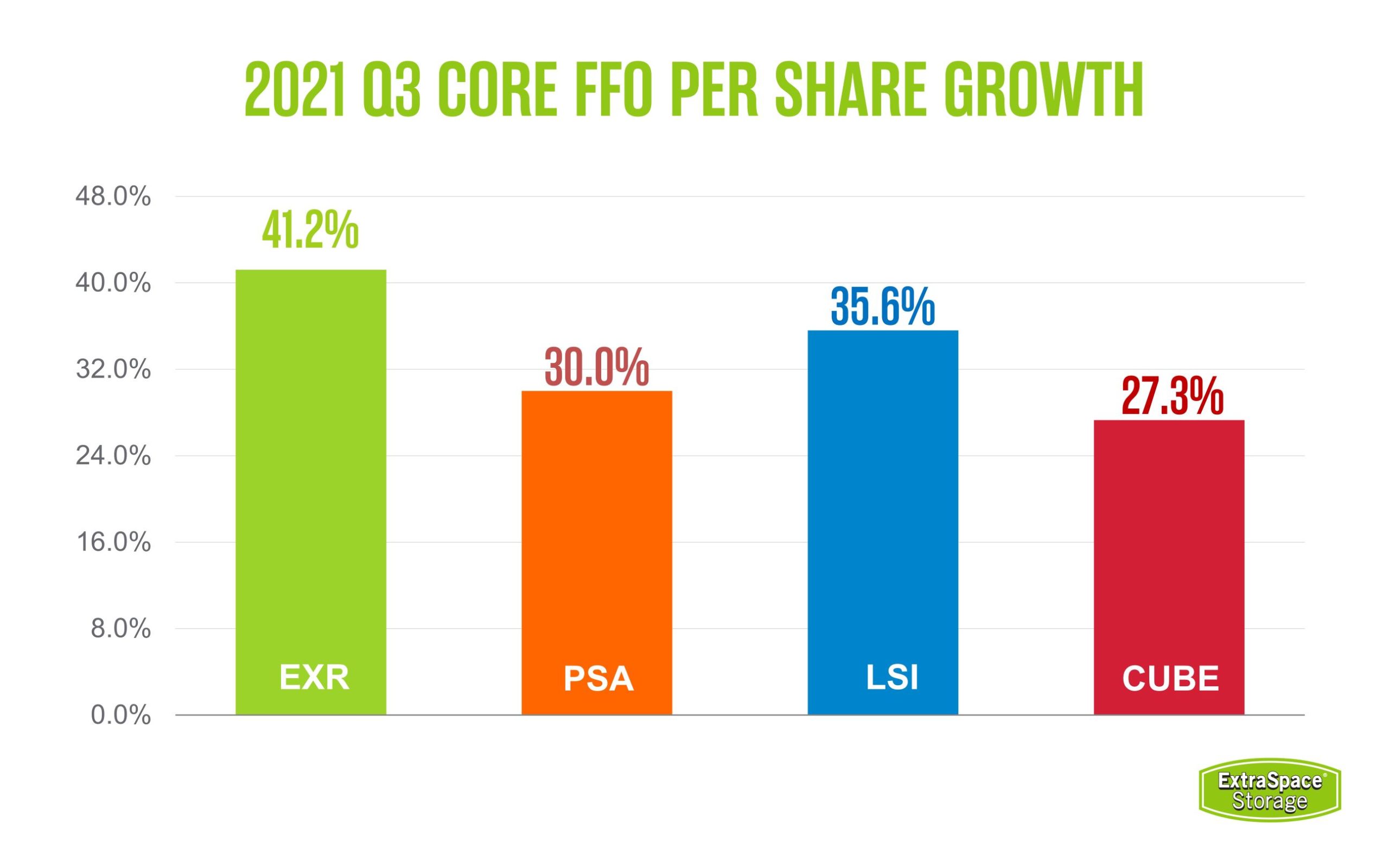

Our strong same-store results plus our efficient external growth coupled to produce exceptionally strong core funds from operations (FFO) growth on a per-share basis of over 41%. This allowed us to increase our dividend for the second time in 2021 to a run rate of $1.25 per share in the third quarter, and a total increase of 38.9% over last year.

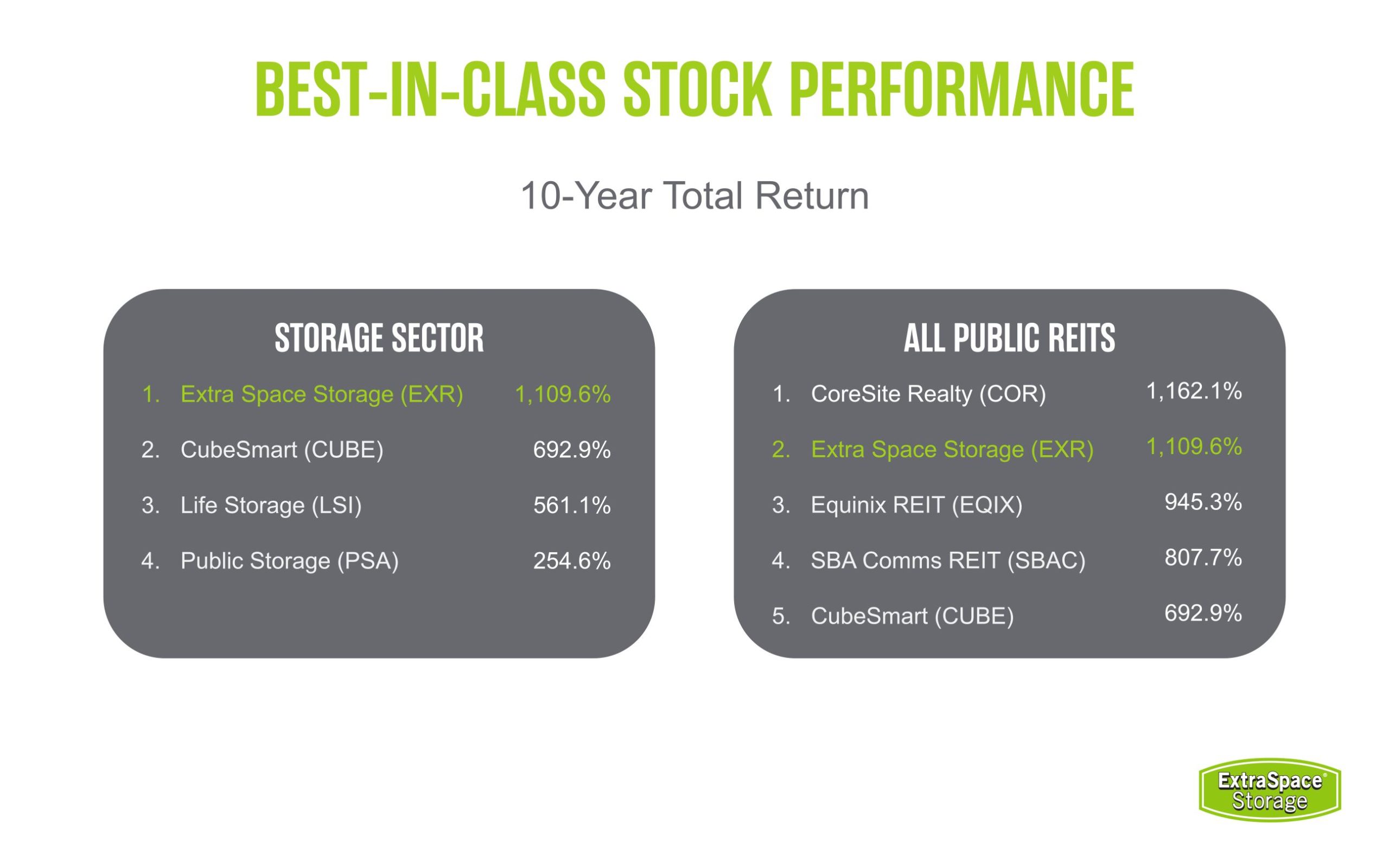

Our strong core FFO growth adds another quarter to our long-term history of core FFO outperformance in the storage sector over the last decade. We believe this is the primary driver of our sector-best 10-year shareholder return and the second highest ten-year return among all REITs.

We are excited to report another strong quarter, and as we always say, it’s a great time to be in storage.

Read our full quarterly earnings report. And learn how investing in Extra Space Storage (NYSE:EXR) helps build a sustainable future beyond the self storage industry.