Is your retirement just around the corner? Even if you’ve been saving and prepping for decades, there are still things you’ll need to prepare for emotionally, mentally, and financially up to your official retirement date. Below, we walk you through how to plan for retirement so you’re ready to kick off your golden years!

Crunch the Numbers

Photo via @your_money_blog

The closer you are to retirement, the more important it is for you to thoroughly review your finances. How much do you have in savings? Do you know what your retirement income will be? Are you aware of tax changes post-retirement? Have you configured your future healthcare costs? Taking the time to crunch the numbers now can save you headaches down the road. Using retirement income calculators and Social Security calculators can help you determine if you have enough money saved, when you can start receiving your Social Security benefits, as well as if you have the means to retire early (should you want that).

Understand Your Social Security Benefits

Photo via @tyjyounginc

To support yourself, your average retirement income will need to be about 70% of your current income. For most people, this income is earned from accrued savings and Social Security payments. Social Security payments are determined by your 35 highest earning years, but you can’t start receiving these benefits until age 62. If you delay receiving Social Security until age 67, however, you can receive 8% more in benefits up to age 70. To get an idea of where you stand with these benefits, sign up for a free Social Security report.

Take Stock of Your Assets & Liabilities

Photo via @myfuturelivinguk

Do you know your personal net worth? While preparing for retirement, make a list of all assets, including cash, real estate, vehicles, personal property, bonds, stocks, and investments. Keeping track of your capital will help you plan around your income sources during retirement. But don’t stop there! Create another list with all liabilities, such as mortgages, auto loans, student loans, personal loans, and credit card debt. Paying off debt is one of the most important steps before retirement because your savings and retirement income will last much longer if you don’t have to make monthly payments toward your debt.

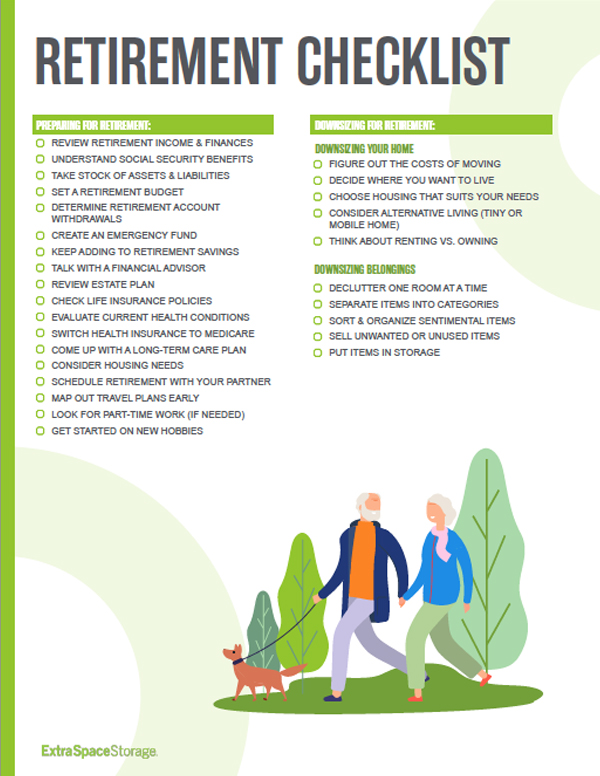

Download Our Retirement Checklist Today!

Looking for an easy way to simplify your life? Download our Retirement Checklist now to help you keep things in perfect order!

Set Your Retirement Budget

Photo via @budgetappkoind

Determining a retirement budget before you retire is crucial to ensuring you don’t overspend your limited income. Create a spreadsheet with all of your anticipated retirement living costs, including everything from groceries and housing to healthcare and taxes. Define which of these expenses are fixed (i.e., occur every month at the same amount) and which are flexible (i.e., occur every month or randomly with different amounts). Knowing this information helps ensure you have your income set up so that you’re receiving enough money each month to cover your expenses but not taking more income than you need.

Determine Retirement Withdrawals

Photo via @investing_in_yours

Once you have your income and budget determined, you’ll need to figure out how to withdraw funds from your retirement accounts. Whether you’re taking money out of your 401(k) or IRA, each have their own set of rules. Traditional IRAs and 401(k)s will have taxes attached to each distribution, and you’ll need to withdraw from these accounts by age 72. If you have a Roth IRA, though, try to let it accrue as long as possible, as these accounts don’t have minimum distributions.

Create an Emergency Fund

Photo via @solivita_living

While a healthy retirement account is important, don’t forget to build up an emergency fund! This savings account should have at least six months worth of income that can cover housing, insurance, and other costs in case of an emergency or delays in your pension. An emergency fund is also critical for early retirement, as you won’t be able to access funds from a Traditional IRA or a 401(k) without a 10% penalty until you’re age 59 1/2.

Keep Adding to Retirement Savings

Photo via @japharmainc

Are you within a few years of retirement and still trying to maximize your savings? Most financial advice recommends around $1 million in savings for retirement, but don’t let that overwhelm you if you’re not quite there yet. Even if you’re within ten years of retirement, you can still make contributions to your retirement account. In addition to the $5,500 yearly contribution (increasing to $6,000 in 2019), Traditional and Roth IRAs allow an extra $1,000 catch-up contribution for those over age 50. With 401(k)s, you can contribute both the $18,500 (increasing to $19,000 in 2019) and up to $6,000 in catch-up contributions!

Talk with a Financial Advisor

Photo via @retirementplanninghelp

Whether you’re retiring early or not, hiring a financial advisor is a great way to help you make smart money decisions before your golden years. Advisors can help you select the right retirement account, advise on investments, and help you create a solid budget. If you want even more advice, a retirement planner can work with you to organize your assets and income sources into a monthly payment during retirement.

Review Your Estate Plan

Photo via @craigdellattorneys

Along with ensuring your finances are in order before retirement, you should also look over your estate plan, which details the dispersion of your assets and liabilities upon your incapacitation or death. Included in this plan are three documents: a living will, a trust, and a will. A living will (also known as an advanced healthcare directive) details your medical preferences and your chosen power of attorney. A trust utilizes a third party to hold assets or benefits for beneficiaries, allowing the distribution of your estate to move more quickly than a traditional will. A will details your wishes for how you want your personal assets divided, which goes into effect after your death. You can make changes to your estate plan as often as you like, provided you’re of sound mind. If you haven’t put together an estate plan yet, do so immediately.

Check Life Insurance Policies

Photo via @efsullivaninsurance

Many employers offer life insurance as a part of their benefits package. However, once you retire, you may lose this coverage. Having life insurance in retirement is a good way for your beneficiaries to be able to pay major expenses like a mortgage or funeral costs after your death. While double-checking, renewing, or replacing a life insurance policy doesn’t have to be one of your first steps when preparing for retirement, it will make the following years more relaxed and carefree. Take time to review your life insurance policy to make sure any outstanding expenses will be covered in the years after your retirement.

Evaluate Your Health Before Retirement

Photo via @chronobiology

Before you leave your current job, take advantage of your employee healthcare plan. Make sure you’re up-to-date on annual checkups, prescriptions, hearing aids, dental care, and vision. Once you’re retired, see your doctor annually (or as covered by your retirement health insurance plan). Maintaining your physical health in retirement is crucial to a good quality of life and can help keep healthcare costs down, so be sure to ask your physician for recommendations on post-retirement health, fitness, and nutrition.

Switch Health Insurance to Medicare

Photo via @buythismore14

Most people are eligible for Medicare (i.e., national health insurance coverage) at age 65, but there are a variety of plans and coverage options you’ll need to evaluate based on your medical needs. Keep in mind Medicare may not cover everything. Prescription costs, copays, hospital costs, and nursing home care may need to be paid out of pocket and can be incredibly expensive if you’re not prepared.

Come Up with a Long-Term Care Plan

Photo via @gadhealthcare

Even if you’re in good health, thinking about long-term care—like nursing home services or a home health aide—is crucial in retirement planning. In fact, nearly 70% of people over age 65 will someday need long-term care services. A long-term health plan should go beyond initial retirement plans, providing financial coverage in case of disability, special needs, or spousal death. Funding a long-term care plan can be challenging, but there are options like long-term care insurance or health savings accounts (HSA). It’s also worth looking into Medicare long-term care when switching your health insurance.

Consider Your Housing Needs

Photo via @featuredproperties

When preparing for retirement, don’t forget about housing. To determine if your current home will be suitable for your golden years, there are a few factors to consider. Is your mortgage paid off? Will you be able to get around your home easily as you age? Do you want to relocate to a new city? Would you prefer to live closer to family and friends? Will you need assisted living in the future? Remember lenders are more likely to provide loans to borrowers with income, so if you’re thinking about downsizing to a condo or moving to a retiree-friendly city, it might be worth making the change before you leave the workforce. If you need advice regarding your housing expenses in retirement, the Retirement Housing Foundation is an excellent resource.

Schedule Your Retirement with Your Partner

Photo via @photographybyami

If you’re married or in a domestic partnership, it’s a good idea to sit down together and discuss your collective retirement goals. Can you retire at the same time? Do you both aspire to early retirement? Will one of you continue to work while the other starts retirement? Getting on the same page can help you come up with a plan and strategize how to best spend your retirement together.

Map Out Your Travel Plans Early

Photo via @vacation_envy_travel

One of the best things about being retired is the ability to travel. Stretch your travel dollars as far as you can by planning ahead! Extended stay hotels are a great option for low-cost housing and making your vacation money last longer. You can also plan lengthier vacations with Airbnb or VRBO, which are often more affordable and flexible than traditional hotels. Whether you want to take an affordable beach vacation or explore the country by RV, be sure to include vacation planning in your retirement checklist!

Look for Part-Time Work

Photo via @harakohei

Some people get a few years into retirement and realize they need more income to support their living costs. Others find that they miss the routine and socialization aspects of the workplace. A part-time job in retirement is an excellent way to keep cash flowing and stay socially active. Substitute teaching, working in retail, assisting with administrative work, and providing child care are all common part-time job options where retirees can find engaging work with flexible schedules.

Get a Head Start on New Hobbies

Photo via @tengiainc

Staying active in retirement not only means exercising and eating well, but it also applies to mental health. Retirees can be at a higher risk for depression if they lose their sense of purpose and community. Even though you may dream of not having to work every day, you’ll still want to stay busy throughout retirement. Explore some new interests or sign up for travel groups, book clubs, and cooking classes. You can also stay active in your social circles by joining a senior center or volunteering with an organization.

***

Are you downsizing or moving as you prepare for retirement? Extra Space Storage can help! We have easily accessible storage facilities across the nation. Rent local storage units now!