Though it can sometimes be overwhelming, preparing for retirement is an exciting journey. Many retirees choose to move into a smaller home to make retired life a little easier. Learn how to downsize your home and your belongings for retirement with this helpful guide!

Should You Downsize Your Home?

If you’re thinking about downsizing for retirement, you’re not alone. Nearly 42% of Americans plan to downsize for their golden years. Moving to a smaller home is an ideal way to lower your monthly living expenses and save time on cleaning and upkeep. Here are some things to consider…

Advantages of Downsizing

- Downsizing gives you an opportunity to clear clutter from your home.

- Moving to a smaller home can lower utility bills, saving you money in the long run.

- A smaller property means less maintenance, cleaning, and upkeep.

- If your current home is paid off, the equity can be a valuable addition to your assets. (You may even be able to sell your current home and buy a smaller home without taking on another mortgage!)

- You might be able to use the capital gains tax in your favor.

Disadvantages of Downsizing

- A smaller home may not have enough space for all of your belongings.

- Moving to a one-bedroom apartment, townhome, or condo means you can’t have overnight guests.

- Packing, moving, and settling in a new home can be physically, mentally, and emotionally taxing.

- You may have to switch from owning a home to renting a home.

- If you live somewhere with an unhealthy real estate market, haven’t built up enough equity, or overestimated your home’s worth, selling might not be a profitable course of action.

How to Downsize Your Home

If you’ve decided to downsize for retirement, there are a few things to keep in mind to prep for your move. Downsizing a home includes determining the costs of selling and moving, choosing what kind of home will work for you as you age, and deciding where you want to spend the next chapter of your life.

Figure Out the Costs of Moving

Photo via @retirementplanninghelp

Downsizing to a condo or townhouse allows you to better utilize living space and cut down on upkeep. However, you don’t want to move to a smaller home only to discover it’s more expensive than the one you left. Before downsizing, take a look at your current housing expenses—like mortgage payments, property taxes, home insurance, utility bills, and maintenance costs—and compare those numbers with what a smaller home would cost. You’ll also need to factor in costs of selling and moving, as well as closing costs, realtor fees, and any updates or improvements that need to be made to your current home. This helpful moving cost calculator can assist you in figuring out what you’ll save in housing costs from downsizing.

HOW MUCH WILL MOVING COST?

Decide Where You Want to Live

Photo via @sandeeshuman

Maybe you want to live somewhere new during your retirement. Or perhaps your current city’s cost of living has gotten too expensive. Regardless, relocating to a retiree-friendly city could help you downsize, save money, and be closer to fun activities. Need a place with better taxes and healthcare costs? Check out these eight tax-friendly places for retirees. Looking for good cities for veterans? Here are the ten best places for retired military. Before deciding on a new place to live, be sure to use a cost of living calculator to evaluate how your amenities, utilities, and housing needs would change from city to city.

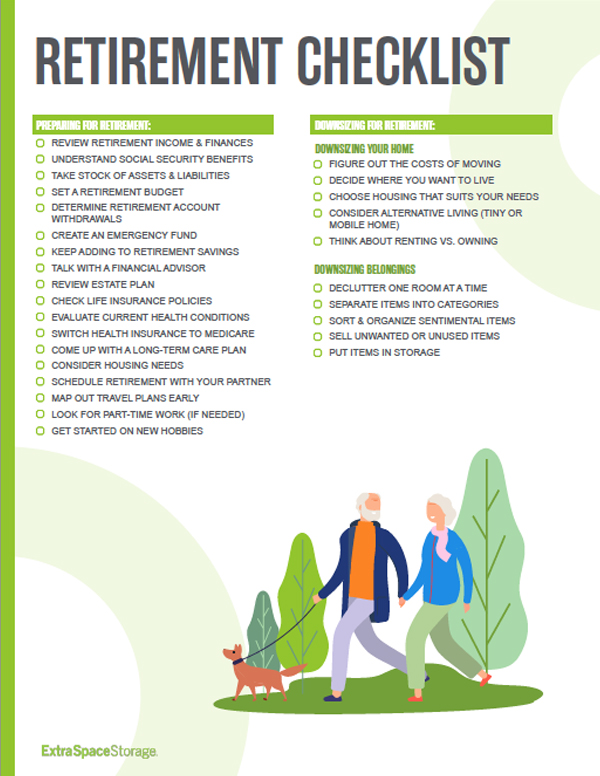

Download Our Retirement Checklist Today!

Looking for an easy way to simplify your life? Download our Retirement Checklist now to help you keep things in perfect order!

Choose Housing That Suits Your Needs

Photo via @orlandomyhome

Finding the best retirement housing option should line up with your goals. Do you want to spend more time with your kids and grandkids? Would you like to travel more often? Are you struggling to keep up with home maintenance? Do you have accessibility or health concerns? Keeping these factors in mind when looking at housing options will help you determine whether downsizing means a smaller house, a condo or townhome, an independent or assisted living facility, or a retirement community.

Consider Alternative Downsizing Options

Photo via @ourwanderlustfamily

Downsizing doesn’t necessarily mean living in an apartment, townhome, or condo. It could be an RV, a houseboat, or a tiny home. Not only do these options allow you to travel more, but you can also work part-time from the road to bring in extra cash and maintain a routine of sorts. Co-housing is another form of alternative housing that can benefit seniors in retirement. These communities are comprised of individual homes built around shared spaces like a common room or garden and encourage the sharing of items among neighbors.

Think About Renting vs. Owning

Photo via @mikefreeman77

Owning a home can provide equity as a line of credit when needed, and a reverse mortgage can provide a valuable source of income. But while many prefer home ownership because of the independence, there are good reasons for renting in retirement. Since most rental properties come with a maintenance staff, you won’t have to worry about paying an average of 1-4% of your home’s value in upkeep costs. Having built-in maintenance is also good considering home improvement can get more difficult as you age. In addition, renting means you won’t have to pay property taxes and higher utility bills, nor will you have to deal with the ups and downs of the real estate market in terms of your home’s resale value.

Downsizing Your Belongings

Whether you decide to move or stay in your current home, minimizing your possessions will free up more space and help you stay organized. This also makes it easier for you and your family should you have to move into assisted living or nursing care later in retirement.

Declutter One Step at a Time

Photo via @thecontainerstore

Trying to clean out your entire home all at once is overwhelming. With these tips for decluttering your home, you can tackle clutter within a time frame that works for you, whether that’s 15 minutes a day or over the course of a month. Enlist family members and friends to help you go through larger areas like the basement, storage rooms, the garage, closets, and the attic more quickly!

Separate Items into Categories

Photo via @being_fi

One of the most important steps for decluttering is to divide and categorize your items. Stick to the four groups: keep, donate, sell, and toss. Start with larger items like furniture first, then make your way down to smaller items like documents, photos, and keepsakes. For easy organizing, use colors for each category and place tape or labels on items in the corresponding color.

Sort Through Sentimental Items

Photo via @neatobsessions

Downsizing the family home and the items you’ve accumulated through the years can be an emotional process. But getting rid of these things can make room for new memories. Talk with your family and schedule days and times for them to go through any items they may want. If they don’t want them, make a goal to either toss or donate those items. If you have any documents, photos, or artwork you can’t part with, consider taking pictures of them and scanning them into an online drive or computer file.

Sell Unwanted or Unused Items

Photo via @purgeslo

A good way to make some extra cash for your retirement is to hold a garage or yard sale for unwanted or unused items. If you and your family don’t want to host a sale on your own, consider working with an estate sale company or auction house. Make sure to get antiques and other valuables appraised so you can get their full value. You can also sell items on sites like eBay, Craigslist, and Facebook Marketplace.

Downsizing can be a great way to create a more manageable retirement lifestyle. Living smaller also makes it easier for you to get out there and explore some of the fun things to do in retirement!

Additional Tips for Decluttering

Apr 7, 2023

Jan 20, 2023

***

Want to keep some of your belongings but don’t have room? Extra Space Storage has convenient storage facilities across the nation that can help with your downsizing transition. Find storage near you!