Buying a house for the first time can be overwhelming, but it’s a lot less stressful when you know what to expect. As you start thinking about buying a home, it’s important to know how the buying process works, what the costs of buying a home are, and how to find the best home for your needs. Below, we break down everything first-time home buyers need to know about purchasing a house!

- Real Estate Market

- Home Buying Timeline

- Pre-Approval Process

- Financing

- Finding a Real Estate Agent

- House Hunting

- Buying the House

- Associated Costs

- Home Inspection

- Moving into Your New Home

Real Estate Market

Just like the stock market, the real estate market goes through constant ebbs and flows. Market conditions can vary wildly between states, cities, and sometimes even between neighborhoods. You should go into your home search knowing what kind of market conditions you’re facing.

Buyer’s Market

In a buyer’s market, the supply of homes on the market is high and prices are low. Sellers will often be more flexible in this type of real estate market, as they know they have less negotiating power on their side. Being in a buyer’s market is the best-case scenario for first-time home buyers.

Seller’s Market

If you’re a first-time buyer in a seller’s market, it’s important to understand that the home buying process will have a few extra roadblocks. Demand for homes will be high, which enables sellers to raise prices. And because there’s more demand, houses sell very quickly—sometimes before they’re even listed. With a seller’s market, you’ll need to anticipate bidding wars and potentially paying more than a home is worth.

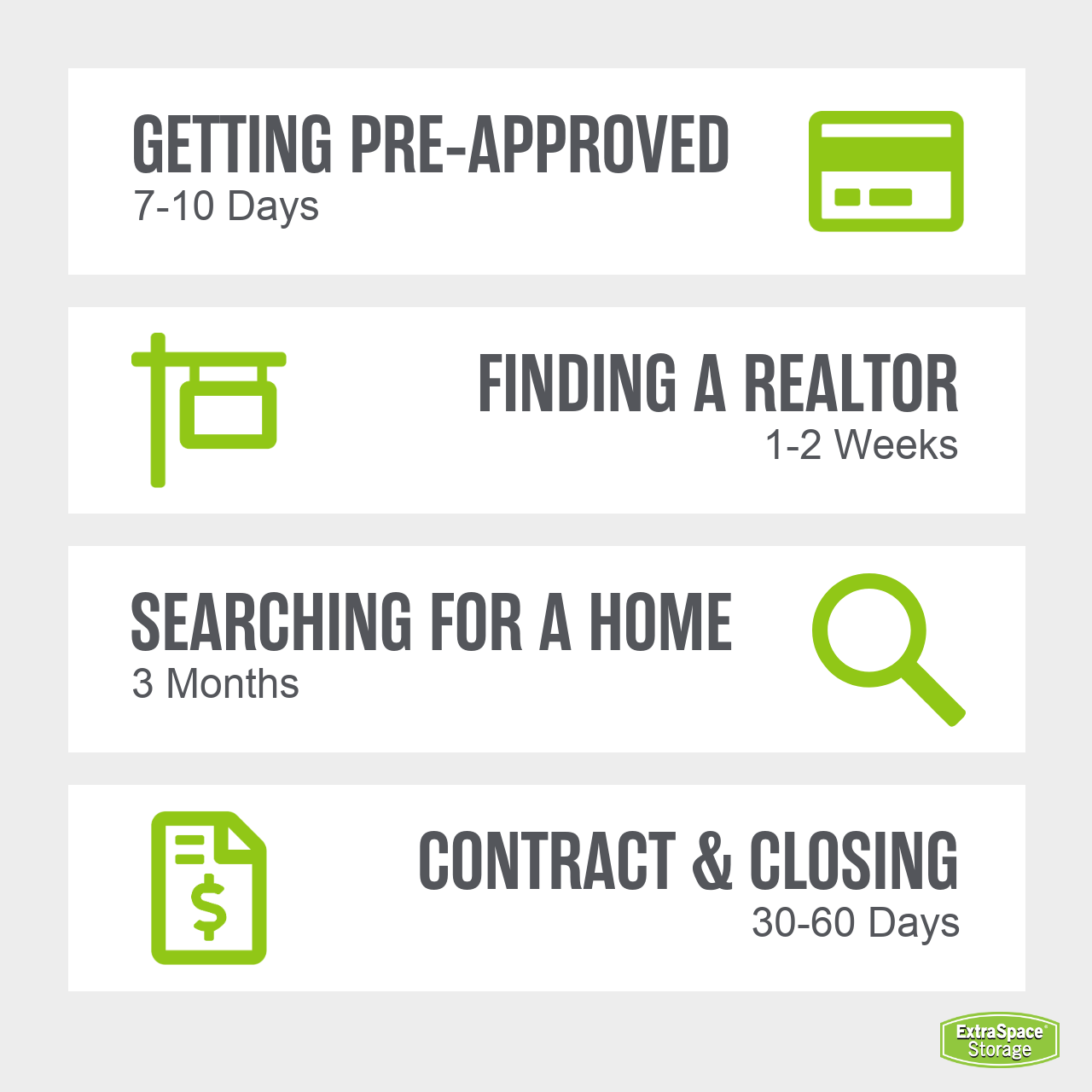

Home Buying Timeline

Between finding a home, making an offer, going under contract, and closing, there are several steps that come with buying a home. While some steps can overlap, in general, the home buying timeline is most likely going to take longer than you may think. Here’s what you need to know…

Finding a Lender & Getting Pre-Approved

Before you do anything else, get your financing in line. First, select a lender. It’s a good idea to talk to a few different lenders to find the best mortgage rate and monthly payment for your situation. Your lender is also the person you’ll work with for the next step: getting pre-approved. The pre-approval process takes the average buyer seven to ten days, but it also allows you to lock in your interest rate.

Choosing a Real Estate Agent

Finding a real estate agent is a big decision and as such should take some time. This is the person who will guide you through most of the home buying process and provide the expertise you need when selecting a home. There are a lot of agents to choose from, so it’s recommended that you interview multiple agents to narrow your choices down. A week or two should be long enough to find and review various candidates.

Searching for a Home

Depending on the state of your local real estate market, the length of your home search can vary significantly. On average, though, home buyers are able to find a property and go under contract (meaning they submitted an offer that was accepted by the seller) within three months.

Going Under Contract & Closing

Once you’ve gone under contract, the rest of the home buying process takes anywhere between 30 to 60 days. This 30 to 60-day period will include home inspection, appraisal, final walkthrough, and end with the closing day.

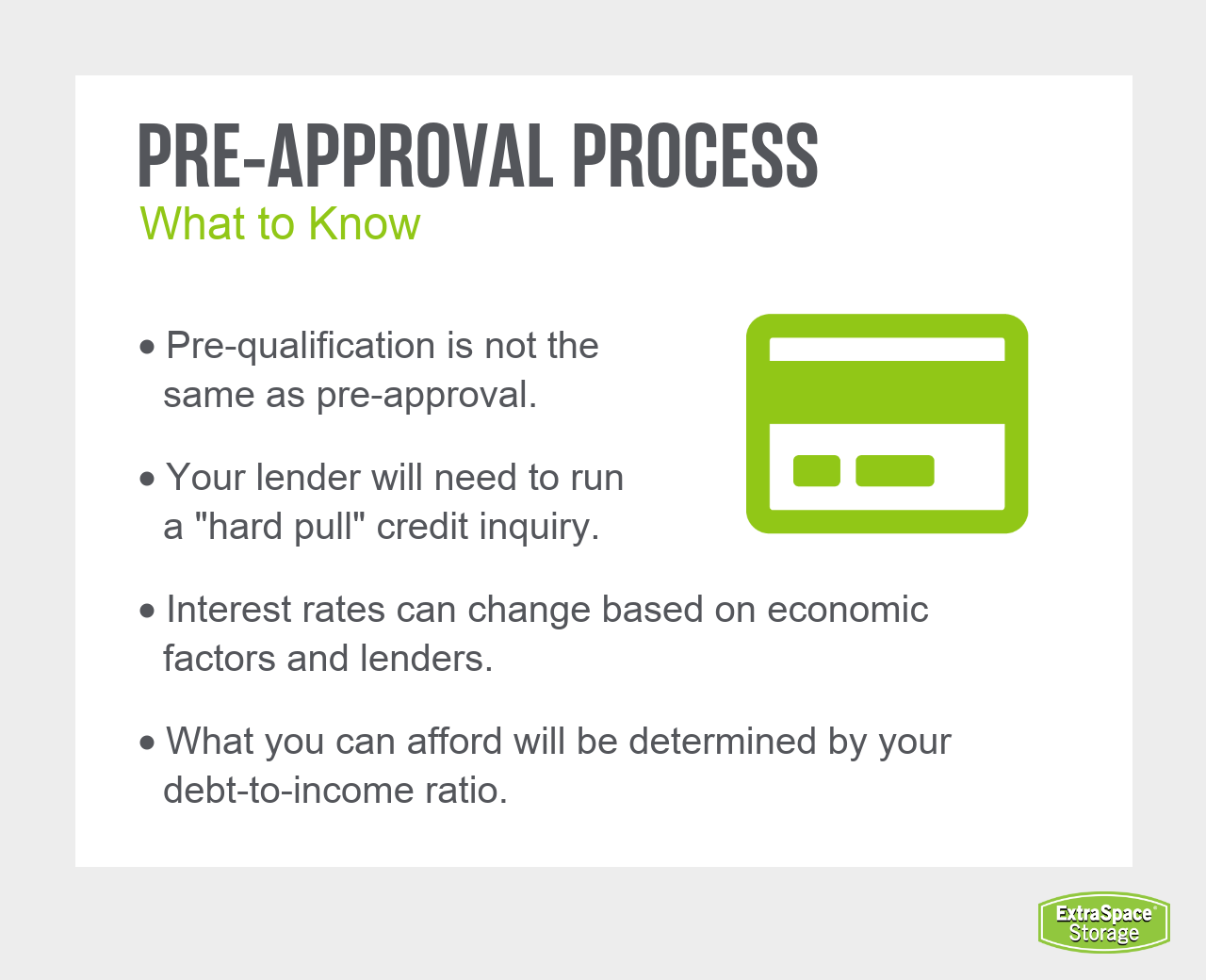

Pre-Approval Process

Before you can start seriously looking at homes, you’ll want to get pre-approved by your lender so that you know how much you’re able to borrow for purchasing a home. As you go through the pre-approval process, keep these things in mind.

Pre-Qualification vs. Pre-Approval

Typically done over the phone, pre-qualification is an informal verification of your worthiness as a buyer. A lender will ask questions about your income, employment, and assets to determine if you’re pre-qualified. Pre-approval, on the other hand, uses relevant documents like W-2s, bank statements, and paystubs to help determine your qualification for a particular type of loan up to a certain dollar amount.

Credit Soft Pull vs. Hard Pull

As part of the home buying process, your lender will check your credit score. There are two ways to check a credit score: soft pulls and hard pulls. Soft pulls are typically used as part of general background checks and will not affect your credit score. Soft pulls don’t need to be authorized, meaning you don’t need to give someone permission to do one. The kind of credit inquiry your lender will use during pre-approval, however, is a hard pull. This is a more formal inquiry, will require your consent, and will temporarily affect your credit score. However, multiple hard pulls within a 45-day window will only count as a single inquiry.

Interest Rates

Like any loan, your mortgage’s interest rate will have a significant impact on how affordable it is. The lower the rate you can lock in, the better. Interest rates change based on economic factors as determined by the Federal Reserve, though different lenders will offer slightly different rates. Even a 1% change in interest rate can greatly change your monthly payment, so it’s a good idea to shop around.

Your Budget

During the pre-approval process, your lender will determine how much you can afford by evaluating your debt-to-income ratio—a figure that compares the difference between your monthly earnings and recurring debts or payments. Look at the price point of homes you’re thinking of buying, then calculate what 3% of that price would be. This is, in most cases, what you’ll need for your down payment at a minimum if you have a conventional loan. Add an additional 2% to 5% for closing costs, as well as about $500 for a home inspection.

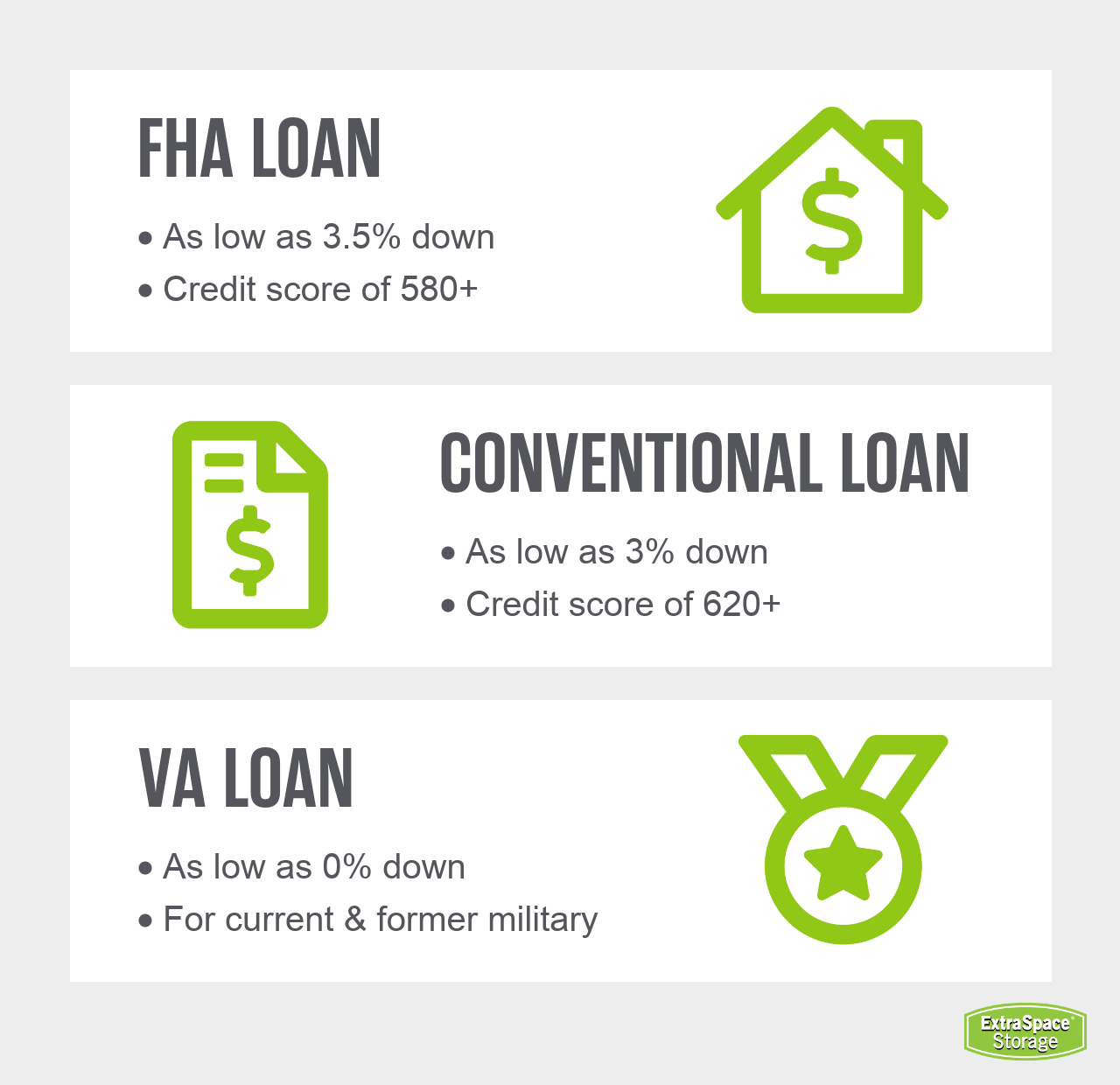

Financing

Conventional wisdom may have you believe that you have to offer 20% of the house price as a down payment to buying a home, but this isn’t the case. There are plenty of loan options and mortgage products available that let you make a far smaller down payment, so you may be ready to buy a home sooner than you think.

FHA Loan

An FHA loan, which is specifically designed for first-time home buyers, allows you to put down as little as 3.5%, assuming you have a credit score of at least 580 and meet the income requirements, which vary by state.

Conventional Loan

Like an FHA loan, a conventional loan lets first-time buyers submit a lower down payment—in this case, as low as 3%. Unlike an FHA loan, though, conventional loans require you to have a credit score of at least 620.

VA Loan

If you’re a current or former member of the U.S. military, you may qualify to make your first home purchase for 0% down with a VA loan. This home mortgage program is an affordable way for service members to buy property without saving up for a large down payment.

Finding a Real Estate Agent

Real estate agents are an essential part of the home buying process. While you might be tempted to go a “do it yourself” route, it’s recommended that you work with a professional. Here’s an introduction to what you need to know about real estate agents and what questions you should be asking when interviewing them.

How Real Estate Agents Help

As a first-time home buyer, it’s a good idea to use a real estate agent to help you navigate the process because they’re more familiar with it. Plus, your agent will be an invaluable resource and provide you with information that isn’t readily available online. For example, not all homes are listed publicly, and only licensed real estate agents have access to these so-called “pocket listings.” In other words, your agent might be able to introduce you to properties you wouldn’t find anywhere else. On top of that, you don’t have to worry about cost when hiring a real estate agent because the seller is responsible for paying the buyer’s agent.

Some Agents Work with Teams

There are two different types of real estate agents out there: those that work on their own and those that belong to a brokerage team. Which kind of agent should you hire? In general, you’ll have more resources at your disposal when you hire an agent who works on a team. Because they have professionals on their side handling back-end tasks like contract paperwork, they can focus their attention solely on representing their clients. However, hiring a solo real estate agent has its benefits as well. When you work with an agent on a team, you’ll be dealing with multiple people throughout the home purchase, which can lead to communication breakdowns. This is less likely to happen if you’re working with just one agent.

Questions to Ask a Real Estate Agent

There are a few key questions you can ask to spot a good real estate agent:

- How long have you been working as an agent?

- How much experience do you have working with buyers?

- How many home buyers did you work with last year?

- Do you have any preferred vendors you work with?

Even first-time buyers without much real estate experience should be able to get a good feel for an agent’s competence by asking these questions. Your buyer’s agreement—the contract between you and the agent that solidifies your working relationship over the course of the home buying process—also contains important information, so be sure to read it over carefully and ask questions if you need clarification.

House Hunting

From visiting listing websites to attending open houses, there are plenty of places you can look to find the perfect home for your unique needs. Using a combination of these strategies, you and your real estate agent should be able to nail down your ideal property.

Home Search Resources

Some of the best resources for house hunters are the email alerts offered by various real estate websites like Redfin, Zillow, Trulia, and Realtor.com. These websites will send you new listings that fit your search criteria so that you can schedule a showing for a home as soon as it hits the market. In addition, there are always open houses. Attending these public showings is a great way to get a feel for properties you’re interested in.

What to Look for in a Home

When searching for homes, a good place to start is by writing a list of “must-haves” and “wants.” On this list, you should include things you want like the style of home (e.g., Craftsman ranch), size of the home, number of bedrooms and bathrooms, preferred location, and desired amenities. It’s also important to look for some base-level indicators that a home is safe and sound—that is, check for signs of water damage, cracks in the walls or foundation, uneven floors, or any other features that seem “off” about a home.

What to Overlook in a Home

Some issues are more serious than others, and many cosmetic flaws should be taken with a grain of salt when you’re viewing a home. Eccentric paint colors, old carpet, or a gaudy backsplash can all cloud your perception of a home’s potential, but those are all things that can be changed. Pay more attention to a property’s location, layout, and size, as most other aspects of a house can be altered.

Buying the House

The moment you find the right home, you’ll need to act quickly if you want to seal the deal. The next steps after you’ve settled on a home are submitting an offer and negotiating with the seller.

Submitting an Offer

Regardless of the kind of market you’re buying in, you’ll undoubtedly come up against competing buyers at some point in your search, so be ready to put your best foot forward. In real estate lingo, this is called submitting your “highest and best” offer. Highest refers to the dollar amount you’re offering, but what makes an offer your best? When reviewing offers, sellers will also consider whether the offer is cash or financed, as well as whether it has any clauses or contingencies. Simply put, these are addendums to the offer that make the deal reliant on a certain condition of the home being met.

Negotiating with the Seller

When you submit an offer on a home, the seller has three options. They can reject your offer, accept your offer, or counter it. Often, they’ll counter it. After all, everyone wants to walk away with the best possible deal. Your real estate agent can help you navigate this step and make suggestions about how to strengthen your deal, whether that means adding onto the offer price, moving up the closing date, or whatever else may sway the seller in your favor. Of course, your agent won’t just work to make the seller happy—they’ll also try to spin things to your advantage. In many circumstances, your agent may be able to negotiate for the seller to pay for some of your closing costs. It all comes down to what’s most important to you and to the seller.

Appraising the Home

It’s also worth knowing that, before you can close on a home, the property you’re buying will have to be appraised. The appraised value of the home must be comparable to the price you’re paying in order for any financing to go through. If it isn’t, you can either walk away from the deal or pay the difference in cash.

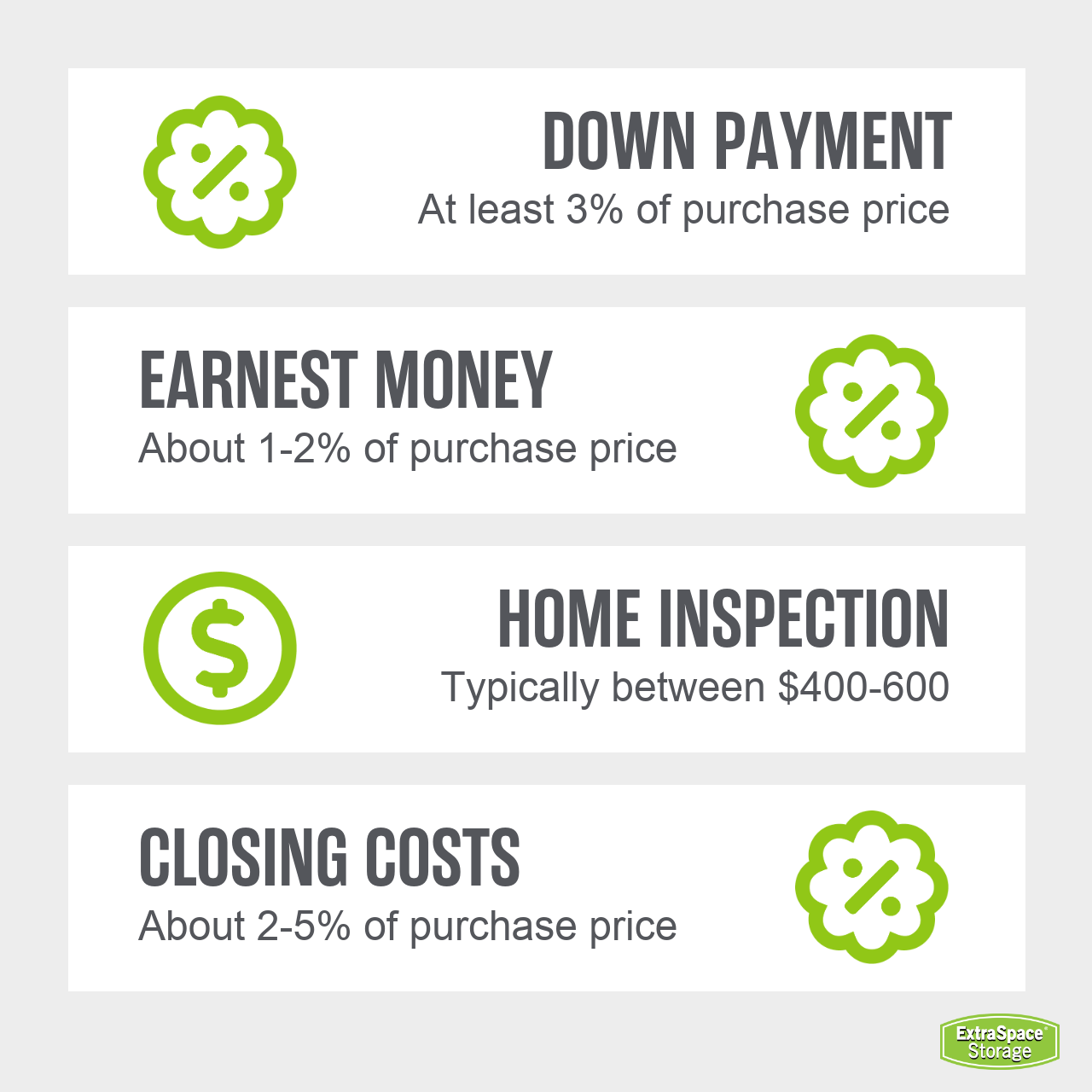

Associated Costs

One of the most critical things to know about buying a house—especially as you’re looking at submitting an offer and negotiating price—is how much it will actually cost to buy and own a home. There are more expenses associated with purchasing property than most people assume.

Down Payment

While you, of course, don’t need to pay the home’s full price on closing day, the down payment will still be a sizable expense. Depending on what loan program you use—assuming you aren’t using one that requires zero money down—you’ll almost always have to submit at least 3% of the purchase price as your down payment. Putting down 20% isn’t necessary, but it can help you avoid accruing additional expenses like private mortgage insurance, which is an insurance policy that protects the lender and is paid for by the home buyer.

Earnest Money Deposit

When you make your offer, your agent will probably suggest that you submit an earnest money deposit. This deposit, which will be applied toward your down payment, if everything goes accordingly, is usually about 1% or 2% of the home purchase price and shows the seller that you’re serious about buying their house.

Home Inspection

A typical home inspection costs between $400 and $600, but additional inspections like mold inspections, termite inspections, and radon inspections will cost extra and will often be done by a different company. Specialty inspections aren’t always necessary, but it’s worth keeping them in mind as you plan your budget.

Closing Costs

On closing day, you’ll write a check or get a money order for your final set of expenses: your closing costs. This will include loan origination fees, taxes, and other expenses related to your mortgage. Closing costs usually run between 2% to 5% of the home purchase price. Depending on your circumstances, your agent may be able to negotiate that the seller pay some or all of these costs. The agent’s commission fees will also be due at this time. Thankfully, in most cases, the seller is responsible for paying commission fees.

Home Inspection

After you’ve gone under contract, you’ll enter the inspection period. During this time, you’ll need to hire a professional home inspector to evaluate your future home for mechanical, structural, and safety issues.

Hiring a Home Inspector

Most real estate agents have preferred vendors and contractors, including home inspectors, that they can refer you to. However, you can also search for a professional of your own choosing.

Types of Home Inspections

The general home inspection provides you with a basic overview of the home’s condition, but it may also reveal a need for additional inspection. There are specialized inspections for almost every issue. If there are major issues with the plumbing, for instance, you may want to hire a plumber for a specialized inspection. Or if the general inspection reveals evidence of infestation, a pest or termite inspection may be required to gain more insight. Other common inspection types are mold inspections, radon inspections, foundation or structural inspections, and electrical inspections.

Resolving Inspection Issues

Depending on how severe an issue from the inspection is, you can ask that the seller fix it, give you the money to fix it, or you can walk away from the house sale entirely without losing your earnest money deposit. If you choose to move forward and the seller opts to give you a credit rather than fixing the issues before closing, the money will be held in an escrow account that you can access after closing and once you’ve made the repair. All you’ll need to do is provide a receipt.

Moving into Your New Home

As you’re handling the details of your home purchase, don’t forget to plan for your actual move. Keeping up with a moving checklist while you’re under contract can help reduce the stress you feel during this transition. Here are some other big steps you’ll want to work into your moving process…

Transfer Utilities & Mail

There are several things you’ll need to update when moving, including utilities, mailing addresses, and school and health records. Make sure to contact your utility providers no less than three weeks in advance so that transferring services goes smoothly; otherwise, you could wind up with no water or power when you move!

Hire Movers

Hiring movers is one of the best ways to make your move less stressful—especially if you’re moving cross country. Like most things during this major life transition, you should arrange to hire movers well in advance. Most moving companies recommend booking moving services about two months out.

Pack Your Items

Declutter your home as you start the packing process, and you’ll find that you have less to pack by the time you’re done. Effective packing will also make unpacking that much easier. Pack by room, and clearly label all your boxes so that you’ll have less trouble finding where everything goes after all is said and done.

Clean Your Old Home

Even though you won’t be living in your old home anymore, you shouldn’t leave it dirty for its new occupants. Sweep, mop, wipe down counters, and deep clean your home before you leave. If you have a rental deposit to get back, this can even help boost your chances of receiving it in full.

Rent a Storage Unit

Sometimes, you’ll find that as you pack, there are items you want out of the way until you’re all set up in your new home. In situations like this, renting a self storage unit temporarily is the perfect solution. If you are not sure what size you need, check out our storage unit size guide for more assistance!

***

Need somewhere to store your belongings while moving? Extra Space Storage has convenient self storage facilities throughout the U.S. to help with your transition. Find affordable storage near you!